reit tax benefits india

Straight-line depreciation can account for approximately 50 of a REITs distributions. The tax on Long Term Capital Gains incurred by.

Bain Backed 44 Billion Wealth Manager Is Bullish On India Reits Bloomberg

But here are also a few benefits to Real Estate companies that form a REIT.

. The 60 ROC scenario reflects the following. Reit tax benefits india Thursday May 26 2022 Edit. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

Assuming a 5 distribution and a 40-year. The hurdle for small investors is the higher min amount that a. Here are the top 3 REIT funds in India.

In India too REITs get a few key tax exemptions that are not available to other types of Real Estate companies. Tax benefits on REITs Latest Breaking News Pictures Videos and Special Reports from The. How REITs are listed on stock.

Taxation considerations for income from investing in InvITs and REITs. Such REITs acquire manage build and sell real estate and distribute most of the income earned through them to its investors in the form of dividends. Tax benefits transparency diversity key advantages of investing in REITs.

Investors in the 10 or 15 tax brackets pay no long-term capital gains taxes while. Tuesday September 27 2022. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

Ambiguity around applicability of. If the REIT held the property for more than one year long-term capital gains rates apply. 4 min read.

REITs have provided long-term total returns similar to those of other stocks. Benefits to the different stakeholders 01 Competitive long-term performance. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi REITs in India.

Withholding tax to be deducted by REIT on distribution Non-resident 5. Till date REITs offer investors. Wachovia Hybrid and Preferred Securities WHPPSM Indicies.

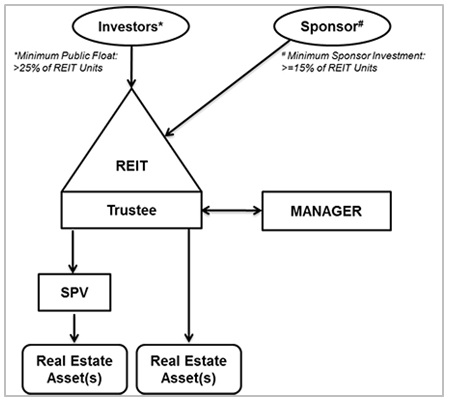

Taxation for unit holders sponsor Interest from SPV Exempt Taxable as interest income Withholding tax to be deducted. How is income from Reits and InvIT taxed. Any money distributed by an InvIT or REIT like interest dividend or rental income for.

Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi REITs in India. Till date REITs offer investors. 25 May 2021 0528 AM IST Gautam Nayak.

The India REIT regime is aimed at an organised market for retail investors to invest and be part of the Indian real. Talking about the REIT tax benefits on long-term REIT real estate investments experts also point out that the interest and dividends received by the REIT from SPVs are exempt from tax on. There are several positives when it comes to the extant tax.

Real Estate Investment Trust REIT is a company that is established with the purpose of channeling investible funds into owning and operating income-generating real.

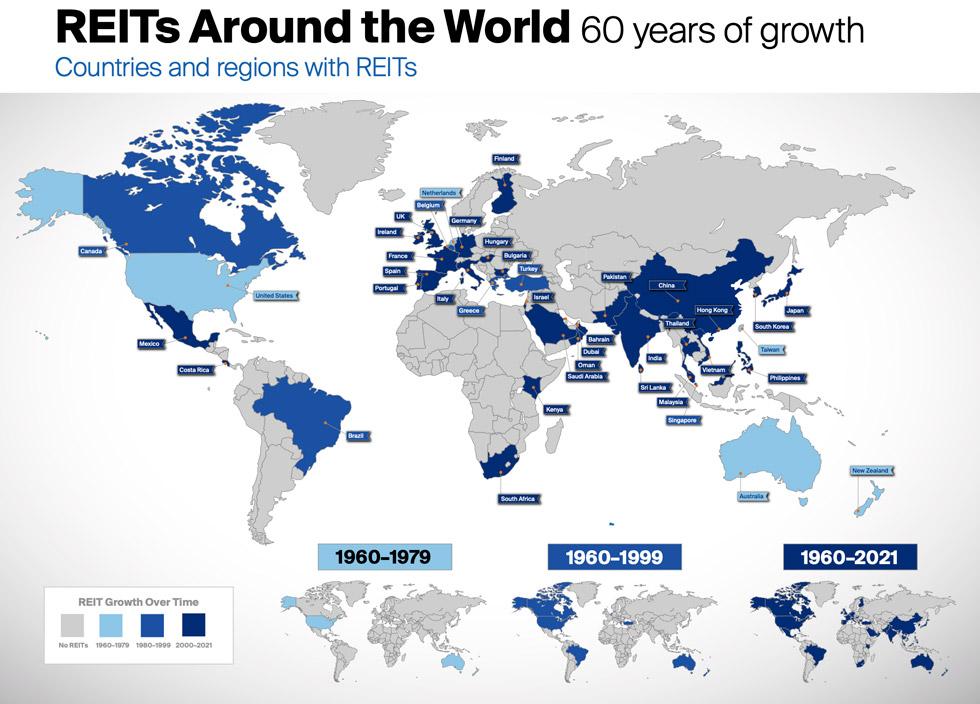

Global Real Estate Investment Nareit

How Reit Regimes Are Doing In 2018 Ey Global

Tweets With Replies By Sigrid Zialcita Sigridzialcita Twitter

How The Tax Equation Changed For Reits And Invits From April 1 2020 The Economic Times

Real Estate Investment Trusts A Primer By Swetha Srinivasan Medium

How To Invest In Reits Forbes Advisor India

Reits In India Features Pros Cons Tax Implications

Real Estate Investment Trust Reits Is A Hybrid Product Between Equity And Fixed Income Which Generates Regular Amp Growing Cash Yields Amp Al Twitter Thread From Mrinal Dhamani Mrinaldhamani Rattibha

Reits To Lure Investors With Tax Free Dividends And Capital Returns Business Standard News

Reit Tax Benefits Questioned As Influence Over Nursing Homes Rises

Real Estate Investment Trusts A Primer By Swetha Srinivasan Medium

Reits Tax Issues And Beyond Mint

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

Are Reits Beneficial During A High Interest Era

Reits In India Structure Eligibility Benefits Limitations Lexology

What Are Real Estate Investment Trusts Reits Benefits And Challenges

Considerations For Reit Or Mlp Formation By Healthcare Not For Profit Organizations Healthcare United States

Know About Reit Real Estate Investment Trust In India Learn2finance